Summary

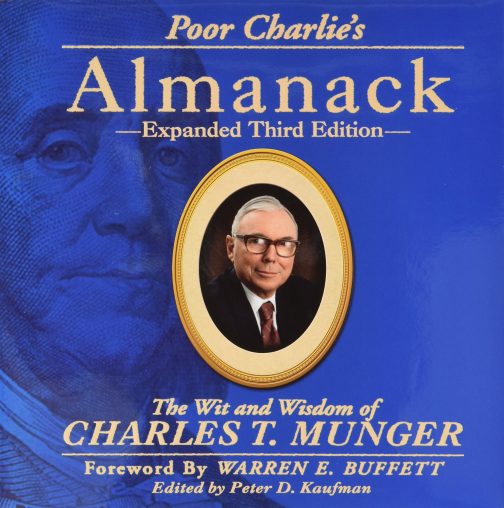

A collection of Charlie Munger’s talks and checklists. Contains his principles for living a good, successful and wealthy life. His talk “The Psychology of Human Misjudgment” is better than any psychology book or course out there. Anyone would do well to (at least) read the eleven talks in this book.

Key Takeaways

- Educational tools

- Morality Tale, in which someone faced an ethical problem and chose the correct path.

- Downward Spiral Tale, in which someone made the wrong choice and suffered an inevitable series of catastrophic personal and professional losses.

- Investing

- Judge the staying quality of the business in terms of its competitive advantage.

- Look for more value in terms of discounted future cash flow than you are paying for.

- You have to understand the odds and have the discipline to bet only when the odds are in your favour.

- True masters of a craft: an uncompromising commitment to “properly playing the hand.”

- Charlie’s use of checklists (see below)

- The Two-Track Analysis

- What are the factors that really govern the interests involved, rationally considered? (for example, macro and micro-level economic factors).

- What are the subconscious influences, where the brain at a subconscious level is automatically forming conclusions? (influences from instincts, emotions, cravings, and so on).

- Investing and Decision-Making Checklist

- Ultra-Simple, General Problem-Solving Notions

- The Two-Track Analysis

- Charlie’s fundamental philosophy of life: Preparation, Discipline, Patience, Decisiveness.

- The way to win is to work, work, work, and hope to have a few insights.

- We look for one-foot fences with big rewards on the other side. So we’ve succeeded by making the world easy for ourselves, not by solving hard problems.

- What we’re really looking for are 50-50 odds which pay three to one.

- Psychology of Human Misjudgment (so valuable that the entire talk is a “key takeaway”)

- Reward and Punishment Superresponse Tendency

- Liking/Loving Tendency

- Disliking/Hating Tendency

- Double-Avoidance Tendency

- Inconsistency-Avoidance Tendency

- Curiosity Tendency

- Kantian Fairness Tendency

- Envy/Jealousy Tendency

- Reciprocation Tendency

- Influence-from-Mere-Association Tendency

- Simple, Pain-Avoiding Psychological Denial

- Excessive Self-Regard Tendency

- Overoptimism Tendency

- Deprival-Superreaction Tendency

- Social-Proof Tendency

- Contrast-Misreaction Tendency

- Stress-Influence Tendency

- Availability-Misweighing Tendency

- Use-It-or-Lose-It Tendency

- Drug-Misinfluence Tendency

- Senescence-Misinfluence Tendency

- Authority-Misinfluence Tendency

- Twaddle Tendency

- Reason-Respecting Tendency

- Lollapalooza Tendency – The Tendency to Get Extreme Consequences from Confluences of Psychological Tendencies Acting in Favour of a Particular Outcome

What I got out of it

The person who popularized the notion of “mental models” and having a checklist of all our psychological tendencies. The Psychology of Human Misjudgment (see bottom of the summary) is one of the best and most useful pieces of the written word I’ve ever read. This should be taught at every school.

The various mental models mentioned throughout the various talks are useful too but are not outlined as well as our psychological tendencies are in the Psychology of Human Misjudgment, so some work is left to us.

Particularly useful are the various checklists included in the book, underlining the importance of incorporating checklist procedures for the important decisions (and tasks) in our life.

Once you’ve been made aware of all your psychological tendencies, you can no longer unsee them.

I wouldn’t call this a life-changing book as I’ve come across most of it elsewhere over the years, but if I had to point someone to one book that can help him or her think more clearly and make better decisions in life, it would be this one. Even better than Seeking Wisdom, in my opinion.

- Summary

- Key Takeaways

- Summary Notes

- Introduction

- Praising Old Age

- Remembering: The Children on Charlie

- The Munger Approach to Life, Learning, and Decision Making

- Mungerisms: Charlie Unscripted

- Talk Two – A Lesson on Elementary Worldly Wisdom as It Relates to Investment Management and Business

- Talk Three – A Lesson on Elementary, Worldly Wisdom, Revisited

- Talk Four – Practical Thought About Practical Thought?

- Talk Five – The Need for More Multidisciplinary Skills from Professionals: Educational Implications

- Charlie’s Checklists

- Talk Six – Investment Practices of Leading Charitable Foundations

- Talk Nine – Academic Economics: Strengths and Faults after Considering Interdisciplinary Needs

- Talk Ten – USC Gould School of Law Commencement Address

- Talk Eleven – The Psychology of Human Misjudgment

Summary Notes

Introduction

Midwestern values for which Charlie has become known: lifelong learning, intellectual curiosity, sobriety, avoidance of envy and resentment, reliability, learning from the mistakes of others, perseverance, objectivity, willingness to test one’s own beliefs and many more.

Praising Old Age

Pride in a job well done is vastly constructive. For instance, it motivates good conduct in early life because, in remembrance, you can make yourself happier when old. To which, aided by modern knowledge, i would add “and, besides, as you pat yourself on the back for behaving well, you will improve your future conduct.”

Remembering: The Children on Charlie

His favourite educational tools were the Morality Tale, in which someone faced an ethical problem and chose the correct path, and the Downward Spiral Tale, in which someone made the wrong choice and suffered an inevitable series of catastrophic personal and professional losses.

The Munger Approach to Life, Learning, and Decision Making

“Simplicity is the end result of long, hard work, not the starting point.” – Frederick Maitland

His models supply the analytical structure that enables him to reduce the inherent chaos and confusion of a complex investment problem into a clarified set of fundamentals.

Examples:

- Redundancy/backup model from engineering

- Compound interest model from mathematics

- Breakpoint/tipping-moment/autocatalysis models from physics and chemistry

- Modern Darwinian synthesis model from biology

- Cognitive misjudgment models from psychology

‘I could improve your ultimate financial welfare by giving you a ticket with only twenty slots in it so that you had twenty punches – representing all the investments that you get to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all. Under those rules, you’d really think carefully about what you did, and you’d be forced to load up on what you’d really thought about. So you’d do so much better.’ – Warren Buffett

Giving Charlie’s methods a name:

Quickly Eliminate the Big Universe of What Not to Do, Follow Up with a Fluent Multidisciplinary Attack on What Remains, Then Act Decisively When, and Only When, the Right Circumstances Appear.

Discipline and Patience: Ted Williams’ Seventy-Seven-Cell Strike Zone

“Ted Williams is the only baseball player who had a .400 single-season hitting record i nthe last seven decades. In the Science of Hitting, he explained his technique. He divided the strike zone into seventy-seven cells, each representing the size of a baseball. He would insist on swinging only at balls in his ‘best’ cells, even at the risk of striking out, because reaching for the ‘worst’ spots would seriously reduce his chances of success. As a securities investor, you can watch all sorts of business propositions in the form of security prices thrown at you all the time. For the most part, you don’t have to do a thing other than be amused. Once in a while, you will find a ‘fat pitch’ that is slow, straight, and right in the middle of your sweet spot. Then you swing hard. This way, no matter what natural ability you start with, you will substantially increas you hitting average. One common problem for investors is that they tend to swing too often. This is true for both individuals and for professional investors operating under institutional imperatives, one version of which drove me out of the conventional long/short hedge fund operations. However, the opposite problem is equally harmful to long-term results: You discover a ‘fat pitch’ but are unable to swing with the full weight of your capital.” – Li Lu of LL Investment Partners

Munger’s Investment Evaluation Process

- Judge the staying quality of the business in terms of its competitive advantage. Look for more value in terms of discounted future cash flow than you are paying for. Move only when you have an advantage. You have to understand the odds and have the discipline to bet only when the odds are in your favour.

- We have three baskets for investing: yes, no, and too tough to understand. To identify potential “yes” candidates, Charlie looks for an easy to understand, dominant business franchise that can sustain itself and thrive in all market environments. Those that survive this first winnowing are subjected to the screens and filters of Charlie’s mental model approach.

- His thoroughness, however, does not cause him to forget his “ecosystem” theme: Sometimes the maximization or minimization of a single factor (notably specialization, as he likes to point out regarding Costco’s discount warehouses) can make that single factor disproportionately important.

Financial reports are merely the beginning of a proper calculation of intrinsic valuation, not the end. The list of additional factors he examines, includes:

- Current and prospective regulatory climate;

- State of labour, supplier, and customer relations;

- Potential impact of changes in technology;

- Competitive strengths and vulnerabilities;

- Pricing power;

- Scalability;

- Environmental issues;

- The presence of hidden exposures

- (Charlie knows that there is no such thing as a riskless investment candidate; he’s searching for those with few risks that are easily understandable.)

Moats

We think in terms of that moat and the ability to keep its width and its impossibility of being crossed as the primary criterion of a great business. And we tell our managers we want the moat widened every year. If the moat is widened every year, the business will do very well.

He assesses a company’s management in the degree to which they are “able, trustworthy, and owner-oriented.” For example:

- How do they deploy cash?

- Do they allocate it intelligently on behalf of the owners, or do they overcompensate themselves, or pursue ego-oriented growth for growth’s sake?

He attempts to assess and understand competitive advantage in every respect – products, markets, trademarks, employees, distribution channels, societal trends, and so on – and the durability of that advantage.

Charlie carefully considers “competitive destruction” forces that, over the long term, lay siege to most companies. They strive to identify and buy only those businesses with a good chance of beating these tough odds.

Charlie seeks to calculate the intrinsic value of the whole business and, with allowance for potential dilution, etc., to determine an approximate value per share to compare to market prices.

Charlie does not immediately rush out and buy it. Knowing that a necessary companion to proper valuation is proper timing, he applies yet a finer screen, a “prior to pulling the trigger” checklist, which is especially useful in evaluating what he refers to as “close calls.” The checklist includes such items as:

- What are current prices, volume, and trading considerations?

- What disclosure timing or other sensitivities exist?

- Are better uses of capital currently or potentially available?

- Is sufficient liquid capital currently on hand or must it be borrowed?

- What is the opportunity cost of that capital?

It is the blend of discipline and patience exhibited by true masters of a craft: an uncompromising commitment to “properly playing the hand.”

A focus on the aforementioned issue of “competitive destruction” and an examination of why some entities are nevertheless able to adapt, survive, and even dominate over time. When this theme is extrapolated into investment selection, the preferred Munger business emerges: Some thrive by outcompeting (a la Selfish Gene) and others by outcooperating (Darwin’s Blind Spot).

How do you compete against a true fanatic? You can only try to build the best possible moat and continuously attempt to widen it.

An Investing Principles Checklist

- Risk – All investment evaluations should begin by measuring risk, especially reputational

- Incorporate an appropriate margin of safety

- Avoid dealing with people of questionable character

- Insist upon proper compensation for risk assumed

- Always beware of inflation and interest rate exposures

- Avoid big mistakes; shun permanent loss of capital

- Independence – “Only in fairy tales are emperors told they are naked”

- Objectivity and rationality require independence of thought

- Remember that just because other people agree or disagree with you doesn’t make you right or wrong – the only thing that matters is the correctness of your analysis and judgment

- Mimicking the herd invites regression to the mean (merely average performance)

- Preparation – “The only way to win is to work, work, work, and hope to have a few insights”

- Develop into a lifelong self-learner through voracious reading: cultivate curiosity and strive to become a little wiser every day

- More important than the will to win is the will to prepare

- Develop fluency in mental models from the major academic disciplines

- If you want to get smart, the question you have to keep asking is “why, why, why?”

- Intellectual humility – Acknowledging what you don’t know is the dawning of wisdom

- Stay within a well-defined circle of competence

- Identify and reconcile disconfirming evidence

- Resist the craving for false precision, false certainties, etc

- Above all, never fool yourself, and remember that you are the easiest person to fool

- Analytic rigour – Use of the scientific method and effective checklists minimizes errors and omissions

- Determine value apart from price; progress apart from activity; wealth apart from size

- It is better to remember the obvious than to grasp the esoteric

- Be a business analyst, not a market, macroeconomic, or security analyst

- Consider totality of risk and effect; look always at potential second order and higher level impacts

- Think forwards and backwards – Invert, always invert

- Allocation – Proper allocation of capital is an investor’s number one job

- Remember that highest and best use is always measured by the next best use (opportunity cost)

- Good ideas are rare – when the odds are greatly in your favour, bet (allocate) heavily

- Don’t “fall in love” with an investment – be situation-dependent and opportunity-driven

- Patience – Resist the natural human bias to act

- “Compound interest is the eighth wonder of the world” (Einstein); never interrupt it unnecessarily

- Avoid unnecessary transactional taxes and frictional costs; never take action for its own sake

- Be alert for the arrival of luck

- Enjoy the process along with the proceeds, because the process is where you live

- Decisiveness – When proper circumstances present themselves, act with decisiveness and conviction

- Be fearful when others are greedy, and greedy when others are fearful

- Opportunity doesn’t come often, so seize it when it does

- Opportunity meeting the prepared mind: that’s the game

- Change – Live with change and accept unremovable complexity

- Recognize and adapt to the true nature of the world around you; don’t expect it to adapt to you

- Continually challenge and willingly amend your “best-loved ideas”

- Recognize reality even when you don’t like it – especially when you don’t like it

- Focus – Keep things simple and remember what you set out to do

- Remember that reputation and integrity are your most valuable assets – and can be lost in a heartbeat

- Guard against the effects of hubris and boredom

- Don’t overlook the obvious by drowning in minutiae

- Be careful to exclude unneeded information or slop: “A small leak can sink a great ship”

- Face your big troubles; don’t sweep them under the rug

Charlie’s fundamental philosophy of life: Preparation, Discipline, Patience, Decisiveness.

The more hard lessons you can learn vicariously, instead of from your own terrible experiences, the better off you will be.

The game is to keep learning, and I don’t think people are going to keep learning who don’t like the learning process.

Mungerisms: Charlie Unscripted

It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.

Investment Advice

- Success means being very patient, but aggressive when it’s time.

- You need to have a passionate interest in why things are happening. That cast of mind, kept over long periods, gradually improves your ability to focus on reality.

- I’d work with very small stocks, searching for unusual mispriced opportunities.

- The keys are discipline, hard work, and practice.

- We measure everything against our alternatives. Intelligent people make decisions based on opportunity costs.

Mental Models

- Part of having uncommon sense is being able to tune out folly, as opposed to recognizing wisdom.

- You have to have a temperament to grab ideas and do sensible things. Most people don’t grab the right ideas or don’t know what to do with them.

A lot of success in life and business comes from knowing what you want to avoid: early death, a bad marriage, etc.

“How can I become like you (rich), except faster?”

- Spend each day trying to be a little wiser than you were when you woke up.

- Discharge your duties faithfully and well.

- Step by step you get ahead, but not necessarily in fast spurts.

- But you build discipline by preparing for fast spurts….Slug it out one inch at a time, day by day.

- At the end of the day if you live long enough – most people get what they deserve.

Talk Two – A Lesson on Elementary Worldly Wisdom as It Relates to Investment Management and Business

What is elementary, worldly wisdom? Well, the first rule is that you can’t really know anything if you just remember isolated facts and try and bang ‘em back. If the facts don’t hang together on a latticework of theory, you don’t have them in a usable form.

You’ve got to have models in your head. And you’ve got to array your experience – both vicarious and direct – on this latticework of models. You may have noticed students who just try to remember and pound back what is remembered. Well, they fail in school and fail in life. You’ve got to hang experience on a latticework of models in your head.

What are the models? Well, the first rule is that you’ve got to have multiple models – because if you have just one or two that you’re using, the nature of human psychology is such that you’ll torture reality so that it fits your models, or at least you’ll think it does. You become the equivalent of a chiropractor, who, of course, is the great boob in medicine.

It’s like the old saying, “To the man with only a hammer, every problem looks like a nail.” And, of course, that’s the way the chiropractor goes about practising medicine. But that’s a perfectly disastrous way to think and a perfectly disastrous way to operate in the world. So you’ve got to have multiple models.

And the models have to come from multiple disciplines – because all the wisdom of the world is not to be found in one little academic department.

But, fortunately, it isn’t that tough – because eighty or ninety important models will carry about ninety percent of the freight in making you a worldly-wise person. And, of those, only a mere handful really carry very heavy freight.

First, there’s mathematics.

The great useful model, after compound interest, is the elementary math of permutations and combinations.

It’s not that hard to learn. What is hard is to get so you use it routinely almost every day of your life. The Fermat/Pascal system is dramatically consonant with the way that the world works. And it’s fundamental truth. So you simply have to have the technique.

If you don’t get this elementary, but mildly unnatural, mathematics of elementary probability into your repertoire, then you go through a long life like a one-legged man in an ass-kicking contest. You’re giving a huge advantage to everybody else.

One of the advantages of a fellow like Buffett is that he automatically thinks in terms of decision trees and the elementary math of permutations and combinations.

You have to know accounting.

Double-entry bookkeeping was a hell of an invention. Although accounting is the starting place, it’s only a crude approximation. And it’s not very hard to understand its limitations.

Carl Braun’s rule at the Braun Company’s communications was called the five Ws – you had to tell who was going to do what, where, when, and why.

Why is that so important? Well, again, that’s a rule of psychology. Just as you think better if you array knowledge on a bunch of models that are basically answers to the question, why, why, why, if you always tell people why, they’ll understand it better, they’ll consider it more important, and they’ll be more likely to comply. Even if they don’t understand your reason, they’ll be more likely to comply.

There’s an iron rule that just as you want to start getting worldly wisdom by asking why, why, why in communicating with other people about everything, you want to include why, why, why. Even if it’s very obvious, it’s wise to stick in the why.

The models that come from hard science and engineering are the most reliable models on this Earth. Engineering quality control is very much based on the elementary mathematics of Fermat and Pascal.

The engineering idea of a backup system is a very powerful idea. The engineering idea of breakpoints – that’s a very powerful model, too. The notion of a critical mass – that comes out of physics – is a very powerful model.

This cost-benefit analysis – hell, that’s all elementary high school algebra.

The next most reliable models are from biology/physiology because, after all, all of us are programmed by our genetic makeup to be much the same.

When you get into psychology, of course, it gets very much more complicated. But it’s an ungodly important subject if you’re going to have any worldly wisdom.

The reason why is that the perceptual apparatus of man has shortcuts in it. The brain cannot have unlimited circuitry. So someone who knows how to take advantage of those shortcuts and cause the brain to miscalculate in certain ways can cause you to see things that aren’t there.

Now you get into the cognitive function as distinguished from the perceptual function. And there, you are equally – more than equally in fact – likely to be misled. Again, your brain has a shortage of circuitry and so forth – and it’s taking all kinds of little automatic shortcuts.

This knowledge, by the way, can be used to control and motivate other people. The most useful and practical part of psychology – which I personally think can be taught to any intelligent person in a week – is ungodly important.

The elementary part of psychology – the psychology of misjudgment – is a terribly important thing to learn. There are about twenty little principles.

I now use a kind of two-track analysis. First, what are the factors that really govern the interests involved, rationally considered? And second, what are the subconscious influences where the brain at a subconscious level is automatically doing these things – which, by and large, are useful but which often malfunction?

One approach is rationality – the way you’d work out a bridge problem: by evaluating the real interests, the real probabilities, and so forth. And the other is to evaluate the psychological factors that cause subconscious conclusions – many of which are wrong.

Then a less reliable form of human wisdom – microeconomics. You’ve got the concept of patents, trademarks, exclusive franchises, and so forth.

Think of an economy as an ecosystem. Just as in an ecosystem, people who narrowly specialize can get terribly good at occupying some little niche. Just as animals flourish in niches, similarly, people who specialize in the business world – and get very good because they specialize – frequently find good economics that they wouldn’t get any other way.

The concept of advantage of scale: these advantages are ungodly important.

But know that there are also disadvantages of scale: the most important being bureaucracy.

Experience curve: the very nature of things is that if you get a whole lot of volume through your operation, you get better at processing that volume.

“You can learn from everybody. I didn’t just learn from reading every retail publication I could get my hands on. I probably learned the most from studying what my competitor was doing across the street.” – Sam Walton

Another rule of psychology – namely, Pavlovian association. If people tell you what you really don’t want to hear, there’s an almost automatic reaction of antipathy. You have to train yourself out of it. It isn’t foredestined that you have to be this way. But you will tend to be this way if you don’t think about it.

Chain stores are quite interesting. Just think about it. The concept of a chain store was a fascinating invention. You get this huge purchasing power – which means that you have lower merchandise costs. You get a whole bunch of little laboratories out there in which you can conduct experiments. And you get specialization.

Sam Walton played the chain store game harder and better than anyone else. Walton invented practically nothing. But he copied everything anybody else ever did that was smart – and he did it with more fanaticism and better employee manipulation. So he just blew right by them all.

Walton, being as shrewd as he was, basically broke other small town merchants in the early days. With his more efficient system, he might not have been able to tackle some titan head-on at the time. But with his better system, he could sure as hell destroy those small town merchants. And he went around doing it time after time after time. Then, as he got bigger, he started destroying the big boys. Well, that was a very, very shrewd strategy.

It’s an interesting model of how the scale of things and fanaticism combine to be very powerful.

Here’s a model that we’ve had trouble with. We’ve tried to figure out why the competition in some markets gets sort of rational from the investor’s point of view so that the shareholders do well, while in other markets there’s destructive competition that destroys shareholder wealth.

But why are cereals so profitable – despite the fact that it looks to me like they’re competing like crazy with promotions, coupons, and everything else? I don’t fully understand it.

Obviously, there’s a brand identity factor in cereals that doesn’t exist in airlines. That must be the main factor that accounts for it.

And maybe the cereal makers, by and large, have learned to be less crazy about fighting for market share.

Unfortunately, I do not have a perfect model for predicting how that’s going to happen.

The great lesson in microeconomics is to discriminate between when technology is going to help you and when it’s going to kill you.

That’s such a wonderful concept – that there are all kinds of wonderful new inventions that give you nothing as owners except the opportunity to spend a lot more money in a business that’s still going to be lousy. The money still won’t come to you. All of the advantages from great improvements are going to flow through to the customers.

Then there’s another model from microeconomics that I call competitive destruction. You know, you have the finest buggy whip factory, and, all of a sudden, in comes this little horseless carriage. And before too many years go by, your buggy whip business is dead. You either get into a different business or you’re dead – you’re destroyed.

There are huge advantages for the early birds. And when you’re an early bird, there’s a model that I call “surfing” – when a surfer gets up and catches the wave and just stays there, he can go a long, long time. But if he gets off the wave, he becomes mired in shallows.

In a long life, you can expect to profit heavily from at least a few of those opportunities if you develop the wisdom and will to seize them. At any rate, “surfing” is a very powerful concept.

Circle of competence: every person is going to have his/her own circle. And it’s going to be very hard to enlarge that circle. You have to figure out what your aptitudes are. You have to figure out where you’ve got an edge. And you’ve got to play within your own circle of competence.

People can rise quite high in life by slowly developing a circle of competence – which results partly from what they were born with and partly from what they slowly develop through work. So some edges can be acquired.

The model I like – to simplify the notion of what goes on in a market for common stocks – is the pari-mutuel system at the race track. If you stop to think about it, a pari-mutuel system is a market. Everybody goes there and bets, and the odds change based on what’s bet. That’s what happens in the stock market.

It’s efficient, yes. But it’s not perfectly efficient. And with enough shrewdness and fanaticism, some people will get better results than others.

The one thing all those winning betters in the whole history of people who’ve beaten the pari-mutuel system have is quite simple: they bet very seldom.

They bet big when they have the odds. And the rest of the time, they don’t. It’s just that simple.

The way to win is to work, work, work, and hope to have a few insights.

How to excel in the stock market:

Just think of it as a heavy odds against game full of bullshit and craziness with an occasional mispriced something or other. And you’re probably not going to be smart enough to find thousands in a lifetime. And when you get a few, you really load up.

As usual in human affairs, what determines the behaviour are incentives for the decision maker, and “getting the incentives right” is a very, very important lesson.

Somebody got the idea to pay all these people not so much an hour, but so much a shift – and when it’s all done, they can all go home. Well, Fedex’s problems of late deliveries cleared up overnight.

Another microeconomics model: Mr. Market.

The trick is getting into better businesses. And that involves all of these advantages of scale that you could consider momentum effects.

How do you get into these great companies? One method is what I’d call the method of finding them small – get ‘em when they’re little.

Ideally, you get into a great business which also has a great manager because management matters.

Betting on the quality of a business is better than betting on the quality of management. In other words, if you have to choose one, bet on the business momentum, not the brilliance of the manager.

Trying to minimize taxes too much is one of the great standard causes of really dumb mistakes.

Anytime anybody offers you anything with a big commission and a 200-page prospectus, don’t buy it. Occasionally, you’ll be wrong if you adopt “Munger’s Rule.” However, over a lifetime, you’ll be a long way ahead – and you will miss a lot of unhappy experiences that might otherwise reduce your love for your fellow man.

Within the growth stock model, there’s a sub-position: there are actually businesses that you will find a few times in a lifetime where any manager could raise the return tremendously just by raising prices – and yet they haven’t done it. So they have huge untapped pricing power that they’re not using. That is the ultimate no-brainer.

You will get a few opportunities to profit from finding underpricing.

Talk Three – A Lesson on Elementary, Worldly Wisdom, Revisited

Great declarers of bridge think: “How can I take the necessary winners?” But they think it through backwards, too. They also think: “What could possibly go wrong that could cause me to have too many losers?” And both methods of thinking are useful. So to win in the game of life, get the needed models into your head and think it through forward and backwards. What works in bridge will work in life.

Mankind invented a system to cope with the fact that we are so intrinsically lousy at manipulating numbers. It’s called the graph. The graph puts numbers in a form that looks like motion. So it’s using some of this primitive neural stuff in your system in a way that helps you understand it.

There are some very fundamental microeconomic reasons why even communist countries should protect trademarks. They don’t all do it, but there are very powerful reasons why they should.

The models that people ought to have in useful form and don’t, perhaps the most important lie in the area of psychology…

Heavy ideology is one of the most extreme distorters of human cognition.

If you get a lot of heavy ideology young – and then you start expressing it – you are really locking your brain into a very unfortunate pattern.

“The five essential entrepreneurial skills for success are concentration, discrimination, organisation, innovation, and communication.” – Michael Faraday

The mind will sometimes flip so that the wish becomes the belief. It will do so at various levels.

Take all the main models from psychology and use them as a checklist for reviewing outcomes in complex systems.

No pilot takes off without going through his checklist: A, B, C, D… And no bridge player who needs two extra tricks plays a hand without going down his checklist and figuring out how to do it.

There’s only one right way to do it: you have to get the main doctrines together and use them as a checklist. And, to repeat for emphasis, you have to pay special attention to combinatorial effects that create lollapalooza consequences.

A very significant fraction of the people in the world will steal if (A) it’s very easy to do and (B) there’s practically no chance of being caught.

Once they start stealing, the consistency principle – which is a big part of human psychology – will soon combine with operant conditioning to make stealing habitual.

If somebody else does it, now you’ve got at least two psychological principles: incentive-caused bias plus social proof. Not only that, but you get Serpico effects: if enough people are profiting in a general social climate of doing wrong, then they’ll turn on you and become dangerous enemies if you try and blow the whistle.

Let’s say you have a desire to do public service. As a natural part of your planning, you think in reverse and ask, “What can I do to ruin our civilization?” That’s easy. If what you want to do is to ruin your civilization, just go to the legislature and pass laws that create systems wherein people can easily cheat. It will work perfectly.

It’s much better to let some things go uncompensated – to let life be hard – than to create systems that are easy to cheat.

The system as designed invites cheating and that human beings are psychologically predisposed to commit fraud when available incentives overwhelm structural checks and balances. As he puts it: “If you want to change behaviours, you have to change motivations.”

When people get bad news, they hate the messenger.

You must stop slop early. It’s very hard to stop slop and moral failure if you let it run for a while.

We look for one-foot fences with big rewards on the other side. So we’ve succeeded by making the world easy for ourselves, not by solving hard problems.

Part of what you must learn is how to handle mistakes and new facts that change the odds. Life, in part, is like a poker game, wherein you have to learn to quit sometimes when holding a much-loved hand.

Disney is an amazing example of autocatalysis. It’s a marvellous model if you can find it. You don’t have to invent anything. All you have to do is to sit there while world carries you forward…

The limits to compounding: the $24 real estate investment by the Dutch to buy the island of Manhattan would today, by some estimates, be roughly equivalent to $3 trillion. Over 378 years, that’s about a seven percent annual compound rate of return.

You’ve got to know what you know and what you don’t know.

Good literature makes the reader reach a little for understanding. Then, it works better. You hold it better. It’s the commitment and consistency tendency.

What works best in most cases is to appeal to a man’s interest.

Things don’t work when it’s unpleasant and easy to put off.

Operant conditioning works – that people will repeat what worked for them the last time.

If you figure something out and do the outlining yourself, the ideas will stick better than if you memorize them using somebody else’s cram list.

Were Charlie to teach a Remedial Worldly Wisdom course for law students, it would no doubt include his “Fundamental four-discipline combination of math, physics, chemistry, and engineering” as well as accounting, history, psychology, philosophy, statistics, biology, and economics. It might, in fact, last somewhat longer than “three weeks or a month.”

Charlie thinks you could create a course that was so interesting – with pithy examples and powerful examples and powerful principles – that it would be a total circus.

Psychology is most powerful when combined with doctrines from other academic departments.

Another powerful mental model: thought experiments.

Charlie believes in the discipline of mastering the best that other people have ever figured out.

Max Planck quotes

- “Science cannot solve the ultimate mystery of nature. And that is because, in the last analysis, we ourselves are a part of the mystery that we are trying to solve.”

- “Scientific discovery and scientific knowledge have been achieved only by those who have gone in pursuit of it without any practical purpose whatsoever in view.”

- “A new scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die, and a new generation grows up that is familiar with it.”

- “It is not the possession of truth, but the success which attends the seeking after it, that enriches the seeker and brings happiness to him.”

Talk Four – Practical Thought About Practical Thought?

Helpful notions:

- Simplify problems by deciding big “no-brainer” questions first.

- Scientific reality is often revealed only by math. Apply numerical fluency.

- Invert. Like the rustic who wanted to know where he was going to die so that he’d never go there.

- What must we avoid because we don’t want it?

- Apply elementary multidisciplinary wisdom, never relying entirely upon others. You must routinely use all the easy-to-learn concepts from the freshman course in every basic subject.

- The really big effects – lollapalooza effects – will often come only from large combinations of factors.

How does one create and maintain conditioned reflexes?

- Operant conditioning

- Classical or Pavlovian conditioning

Operant conditioning is easy to solve. We need only (1) maximize rewards of our beverage’s ingestion and (2) minimize possibilities that desired reflexes, once created by us, will be extinguished through operant conditioning by proprietors of competing products.

A competing product, if never tried, can’t act as a reward creating a conflicting habit. Every spouse knows that.

In Pavlovian conditioning, powerful effects come from mere association.

The brain of man years for the type of beverage held by the pretty woman he can’t have. For as long as we are in business, our beverage and its promotion must be associated in consumer minds with all other things consumers like or admire.

Social proof, imitative consumption triggered by mere sight of consumption, will not only help induce trial of our beverage. It will also bolster perceived rewards from consumption.

The best way to avoid envy is to plainly deserve the success we get.

Einstein said that one of the four causes of his achievement was self-criticism, ranking right up there alongside curiosity, concentration, and perseverance.

One of Charlie’s favourite ads: “The company that needs a new machine tool, and hasn’t bought it, is already paying for it.”

Talk Five – The Need for More Multidisciplinary Skills from Professionals: Educational Implications

There are frequent, terrible effects in professionals from intertwined subconscious mental tendencies, two of which are exceptionally prone to cause trouble:

- Incentive-caused bias, a natural cognitive drift toward the conclusion that what is good for the professional is good for the client and the wider civilization.

- Man-with-a-hammer tendency.

“Not ignorance, but ignorance of ignorance is the death of knowledge.” – Alfred North Whitehead

Look where incentives for effective education are strongest and results are most closely measured: pilot training. They’re trained in a strict six-element system:

- His formal education is wide enough to cover practically everything useful in piloting.

- His knowledge of practically everything needed by pilots is not taught just well enough to enable him to pass one test or two; instead, all his knowledge is raised to practice-based fluency, even in handling two or three intertwined hazards at once.

- Like any good algebraist, he is made to think sometimes in a forward fashion and sometimes in reverse; and so he learns when to concentrate mostly on what he wants to happen and also when to concentrate mostly on avoiding what he does not want to happen.

- His training time is allocated among subjects so as to minimize damage from his later malfunctions; and so what is most important in his performance gets the most training coverage and is raised to the highest fluency levels.

- “Checklist” routines are always mandatory for him.

- Even after original training, he is forced into a special knowledge-maintenance routine: regular use of the aircraft simulator to prevent atrophy through long disuse of skills needed to cope with rare and important problems.

We need for best results to have multidisciplinary coverage of immense amplitude, with all needed skills raised to an ever-maintained practice-based fluency, including considerable power of synthesis at boundaries between disciplines, with the highest fluency levels being achieved where they are most needed, with forward and reverse thinking techniques being employed in a manner reminding one of inversion in algebra, and with “checklist” routines being a permanent part of the knowledge system.

You must both rank and use disciplines in order of fundamentalness.

Truth is hard to assimilate in any mind when opposed by interest.

Charlie’s Checklists

The Two-Track Analysis

- What are the factors that really govern the interests involved, rationally considered? (for example, macro and micro-level economic factors).

- What are the subconscious influences, where the brain at a subconscious level is automatically forming conclusions? (influences from instincts, emotions, cravings, and so on).

Investing and Decision-Making Checklist

See An Investing Principles Checklist above.

Ultra-Simple, General Problem-Solving Notions

See Talk 4 above.

Psychology-Based Tendencies

See The Psychology of Human Misjudgment below.

Talk Six – Investment Practices of Leading Charitable Foundations

“What a man wishes, he will believe.” – Demosthenes

Biological creatures ordinarily prefer effort minimization in routine activities and don’t like removals of long-enjoyed benefits.

What we’re really looking for are 50-50 odds which pay three to one.

“The way to gain a good reputation is to endeavour to be what you desire to appear.” – Socrates

“Pleasure is the greatest incentive to evil.” – Plato

Several instances when, if you want the physical volume to go up, the correct answer is to increase the price?

- Luxury goods. By raising the price the utility of the goods is improved for someone engaging in conspicuous consumption. Further, people will frequently assume that the high price equates to a better product, and this can sometimes lead to increased sales.

- Non-luxury goods: higher price connotes higher value. This applies especially to industrial goods where high reliability is an important factor.

- Raise the price and use the extra revenue in legal ways to make the product work better or to make the sales system work better.

- Raise the price and use the extra revenue in illegal ways to drive sales by the functional equivalent of bribing purchasing agents or in other ways detrimental to the end consumer, i.e., mutual fund commission practices.

Talk Nine – Academic Economics: Strengths and Faults after Considering Interdisciplinary Needs

What’s wrong with academic economics:

- Fatal unconnectedness, leading to man-with-a-hammer syndrome, often causing overweighing what can be counted

- Failure to follow the fundamental full-attribution ethos of hard science

- Physics envy

- Too much emphasis on macroeconomics

- Too little synthesis in economics

- Extreme and counterproductive psychological ignorance

- Too little attention to second- and higher-order effects

- Not enough attention to the concept of febezzlement

- Galbraith’s idea was that, if you have an undisclosed embezzlement, it has a wonderful Keynesian stimulating effect on the economy because the guy who’s been embezzled thinks he is as rich as he always was and spends accordingly, and the guy that has stolen the money gets all this new purchasing power. I think that’s correct analysis on Galbraith’s part. The trouble with his notion is that he’s described a minor phenomenon. Because when the embezzlement is discovered, as it almost surely will be, the effect will quickly reverse. So the effect quickly cancels out.

- Not enough attention to virtue and vice effects

- “Not Enough Attention to the Effects of Embedded Ponzi Schemes at the Microeconomic Level.”

“If you would persuade, appeal to interest and not to reason.” – Benjamin Franklin

Opportunity cost is a superpower, to be used by all people who have any hope of getting the right answer. Also, incentives are superpowers. And lastly, the tragedy of the commons model.

Practically everyone (1) overweighs the stuff that can be numbered because it yields to the statistical techniques they’re taught in academia and (2) doesn’t mix in the hard-to-measure stuff that may be more important.

The sort of precise, reliable formula that includes Boltzmann’s constant is not going to happen, by and large, in economics. It involves too complex a system.

Economics should emulate physics’ basic ethos, but its search for precision in physics-like formulas is almost always wrong in economics.

Extreme success is likely caused by some combination of the following factors:

- Extreme maximization or minimization of one or two variables. Example, Costco.

- Adding success factors so that a bigger combination drives success, often in nonlinear fashion, as one is reminded by the concept of breakpoint and the concept of critical mass in physics. Often results are not linear. You get a little bit more mass, and you get a lollapalooza result.

- An extreme of good performance over many factors. Example, Toyota or Les Schwab.

- Catching and riding some sort of big wave. Example, Oracle.

The second interesting problem with synthesis involves two of the most famous examples in economics. Number one is Ricardo’s principle of comparative advantage in trade, and the other is Adam Smit’s pin factory. And both of these, of course, work to vastly increase economic output per person, and they’re similar in that each somehow directs functions in to the hands of people who are very good at doing the functions. Yet, they’re radically different examples in that one of them is the ultimate example of central planning – the pin factory – where the whole system was planned by somebody, while the other example, Ricardo’s, happens automatically as a natural consequence of trade.

Frequently overlooked is that Ricardo’s comparative advantage in “delegating” tasks among nations is equally applicable for managers delegating work. Even if a manager can perform the full range of tasks better himself, it is still mutually advantageous to divide them up.

All human systems are gamed.

Economic systems work better when there’s an extreme reliability ethos. And the traditional way to get a reliability ethos was through religion. The religions instilled guilt.

If directors were significant shareholders who got a pay of zero, you’d be amazed what would happen to unfair compensation of corporate executives as we dampened effects from reciprocity tendency.

The cravings for perfect fairness causes a lot of terrible problems in system function. Some systems should be made deliberately unfair to individuals because they’ll be fairer on average for all of us. Thus, there can be virtue in apparent non-fairness.

Vice effects in economics: bubbles with much fraud and folly.

Another interesting vice effect involves envy. This is a great driver of proclivity to spend. And so, here this terrible vice, which is forbidden in the Ten Commandments, and here it’s driving all these favourable results in economics. There’s some paradox in economics that nobody’s going to get out.

“Better roughly right than precisely wrong.” – Keynes

Mandeville’s philosophy: altruism harms the state and its intellectual progress and self-interested human vice is the real engine of progress. Thus the paradox that “private vices are public benefits.”

“Where there is no bread, there is no law; where there is no law, there is no bread.”

“Capitalism works best when there is trust in the system.” – Charlie Munger

Talk Ten – USC Gould School of Law Commencement Address

In Confucius thought, filial piety – a love and respect for one’s parents and ancestors – is a virtue to be cultivated. More broadly, “filial piety” means to take care of one’s parents; not be rebellious; show love, respect and support; display courtesy; ensure male heirs; uphold fraternity among brothers; wisely advise one’s parents; conceal their mistakes; display sorrow for their sickness and death; and carry out sacrifices after their death.

You want to deliver to the world what you would buy if you were on the other end.

The acquisition of wisdom is a moral duty.

Just as civilization can progress only when it invents the method of invention, you can progress only when you learn the method of learning.

You can cause enormous offence by being right in a way that causes somebody else to lose face in his own discipline or hierarchy.

An “iron prescription” to keep sane when drifting toward preferring one intense ideology over another: you’re not entitled to an opinion unless you can state the arguments against better than the people who are in opposition.

Generally, envy, resentment, revenge and self-pity are disastrous modes of thought. Self-pity can get pretty close to paranoia. And paranoia is one of the very hardest things to reverse.

You also want to get self-serving bias out of your mental routines. Thinking that what’s good for you is good for the wider civilization, and rationalizing foolish or evil conduct, based on your subconscious tendency to serve yourself, is a terrible way to think.

If you don’t allow for self-serving bias in the conduct of others, you are a fool.

Another thing to avoid is being subjected to perverse incentives. You don’t want to be in a perverse incentive system that’s rewarding you if you behave more and more foolishly, or worse and worse.

Maximizing non-egality often works wonders.

The game of competitive life often requires maximizing the experience of the people who have the most aptitude and the most determination as learning machines. And if you want the very highest reaches of human achievement, that’s where you have to go.

You want to provide a lot of playing time for your best players.

Intense interest in any subject is indispensable if you’re really going to excel in it.

Have a lot of assiduity. To me it means: sit down on your ass until you do it.

Complex bureaucratic procedure does not represent the highest form civilization can reach. One higher form is a seamless, non-bureaucratic web of deserved trust.

In your own life what you want to maximize is a seamless web of deserved trust.

Quotes from Epictetus

- First learn the meaning of what you say, and then speak.

- He is a wise man who does not grieve for the things which he has not, but rejoices for those which he has.

- It is impossible to begin to learn that which one thinks one already knows.

- Make the best use of what is in your power, and take the rest as it happens.

- People are not disturbed by things, but by the view they take of them.

- Wealth consists not in having great possessions, but in having few wants.

Talk Eleven – The Psychology of Human Misjudgment

Man is easily fooled, either by the cleverly thought out manipulation of man, by circumstances occurring by accident, or by very effective manipulation practices that man has stumbled into during “practice evolution” and kept in place because they work so well.

If stimulus is kept below a certain level, it does not get through.

Psychological tendencies

- Reward and Punishment Superresponse Tendency

- Never, ever, think about something else when you should be thinking about the power of incentives.

- Perhaps the most important rules in management is “Get the incentives right.”

- “Repeat behaviour that works.”

- Prompt rewards work much better than delayed rewards in changing and maintaining behaviour.

- Incentives are superpowers.

- General antidotes to professional advice with incentive-caused bias

- Fear professional advice when it is especially good for the advisor

- Learn and use the basic elements of your advisor’s trade as you deal with your advisor

- Double check, disbelieve, or replace much of what you’re told, to the degree that seems appropriate after objective thought

- Bad behaviour is intensely habit-forming when it is rewarded.

- Difficult decisions involving trade-offs are common in creating compensation arrangements in the sales function.

- Dread, and avoid as much as you can, rewarding people for what can be easily faked.

- “Granny’s Rule” provides another example of reward superpower: the requirement that children eat their carrots before they get dessert. And the business version requires that executives force themselves daily to first do their unpleasant and necessary tasks before rewarding themselves by proceeding to their pleasant tasks. Given reward superpower, this practice is wise and sound. The emphasis on daily use of this practice is not accidental: prompt rewards work best, after all.

- Liking/Loving Tendency

- Each child, like a gosling, will almost surely come to like and love, not only as driven by its sexual nature, but also in social groups not limited to its genetic or adoptive “family”.

- What will a man naturally come to like and love, apart from his parent, spouse and child? Well, he will like and love being liked and loved. And so many a courtship competition will be won by a person displaying exceptional devotion, and man will generally strive, lifelong, for the affection and approval of many people not related to him.

- One very practical consequence of this tendency is that it acts as a conditioning device that makes the liker or lover tend…

- To ignore faults of, and comply with wishes of, the object of his affection.

- To favour people, products and actions merely associated with the object of his affection.

- To distort other facts to facilitate love.

- Liking and loving causing admiration also works in reverse. Admiration causes or intensifies liking or love.

- Disliking/Hating Tendency

- This tendency acts as a conditioning device that makes the disliker/hater tend to…

- Ignore virtues in the object of dislike.

- Dislike people, products and actions merely associated with the object of dislike.

- Distort other facts or facilitate hatred.

- This tendency acts as a conditioning device that makes the disliker/hater tend to…

- Double-Avoidance Tendency

- The brain of man is programmed with a tendency to quickly remove doubt by reaching some decision.

- The one thing that is surely counterproductive for a prey animal that is threatened by a predator is to take a long time in deciding what to do.

- What usually triggers this tendency is some combination of (1) puzzlement and (2) stress. And both of these factors naturally occur in facing religious issues.

- Inconsistency-Avoidance Tendency

- The brain of man conserves programming space by being reluctant to change, which is a form of inconsistency avoidance. We see this in all human habits, constructive and destructive.

- Much easier to prevent a habit than to change it.

- Also tending to be maintained in place by the anti-change tendency of the brain are one’s previous conclusions, human loyalties, reputational identity, commitments, accepted role in a civilization, etc.

- The new ideas were not accepted because they were inconsistent with old ideas in place.

- Antidote to first conclusion bias (by Darwin): to intensively consider any evidence tending to disconfirm any hypothesis of his, more so if he thought his hypothesis was a particularly good one.

- Good effects of this tendency in civilization: most people are more loyal in their roles.

- A person making big sacrifices in the course of assuming a new identity will intensify his devotion to the new identity.

- Civilization has invented many tough and solemn initiation ceremonies, often public in nature, that intensify new commitments made.

- Franklin would often manoeuvre that man into doing Franklin some unimportant favour, like lending Franklin a book. Thereafter, the man would admire and trust Franklin more because a nonadmired and nontrusted Franklin would be inconsistent with the appraisal implicit in lending Franklin the book.

- When one is manoeuvred into deliberately hurting some other person, one will tend to disapprove or even hate that person.

- Given the psychology-based hostility natural in prisons between guards and prisoners, an intense, continuous effort should be made…

- To prevent prisoner abuse from starting.

- To stop it instantly when it starts because it will grow by feeding on itself, like a cluster of infectious disease.

- So strong is this tendency that it will often prevail after one has merely pretended to have some identity, habit, or conclusion.

- “Status quo bias” can cause benefit: a near-ultimate inconsistency would be to teach something to others that one did not believe true.

- Clinical medical education uses this: “see one, do one, and then teach one,” with the teaching pounding the learning into the teacher.

- Curiosity Tendency

- In advanced human civilization, culture greatly increases the effectiveness of curiosity in advancing knowledge.

- Kantian Fairness Tendency

- Humans follow those behaviour patterns that, if followed by others, would make the surrounding human system work best for everybody.

- Reciprocity is a courtesy many desire when roles are reversed.

- Reactive hostility occurs when fair sharing is expected yet not provided.

- Envy/Jealousy Tendency

- As we’re designed through the evolutionary process to want often-scarce food, we’re going to be driven strongly toward getting food when we first see food.

- Sibling jealousy is clearly very strong and usually greater in children than adults. It is often stronger than jealousy directed at strangers. This tendency probably contributes to this result.

- “It is not greed that drives the world, but envy.” – Warren Buffett

- When did any of you last engage in any large group discussion of some issue wherein adult envy/jealousy was identified as the cause of someone’s argument?

- Reciprocation Tendency

- The automatic tendency of humans to reciprocate both favours and disfavours has long been noticed as extreme.

- This tendency clearly facilitates group cooperation for the benefit of members.

- The standard antidote to one’s overactive hostility is to train oneself to defer reaction.

- Commercial trade, a fundamental cause of modern prosperity, is enormously facilitated by man’s innate tendency to reciprocate favours.

- This tendency, insomuch as it causes good results, does not join forces only with the superpower of incentives. It also joins Inconsistency-Avoidance Tendency in helping cause…

- The fulfilment of promises made as part of a bargain, including loyalty promises in marriage ceremonies.

- Correct behaviour expected from persons serving as priests, shoemakers, physicians, and all else.

- This tendency operates to a very considerable degree at a subconscious level.

- The simplest antidote (to reduce preferential treatment by sales people) works best: Don’t let them accept any favours from vendors.

- What Cialdini’s “compliance practitioners” had done was to make a small concession, which was reciprocated by a small concession from the other side. This subconscious reciprocation of a concession by Cialdini’s experimental subjects actually caused a much increased percentage of them to end up irrationally agreeing to go to a zoo with juvenile delinquents.

- This tendency subtly causes many extreme and dangerous consequences, not just on rare occasions but pretty much all the time.

- The reciprocity-based, religion-boosting idea of obtaining help from God in reciprocation for good human behaviour has probably been vastly constructive.

- This tendency’s constructive contributions to man far outweigh its destructive efforts.

- The very best part of human life probably lies in relationships of affection wherein parties are more interested in pleasing than being pleased.

- Guilt: the most plausible cause is the mental conflict triggered in one direction by reciprocation tendency and in the opposite direction by reward superresponse tendency pushing one to enjoy one hundred percent of some good thing.

- Influence-from-Mere-Association Tendency

- In the standard conditioned reflexes studied by Skinner and most common in the world, responsive behaviour, creating a new habit, is directly triggered by rewards previously bestowed.

- Another type of conditioned reflex wherein mere association triggers a response: many men who have been trained by their previous experiences in life to believe that when several similar items are presented for purchase, the one with the highest price will have the highest quality.

- Even association that appears to be trivial, if carefully planned, can have extreme and peculiar effects on purchasers of products.

- Some of the most important miscalculation come from what is accidentally associated with one’s past success, or one’s liking and loving, or one’s disliking and hating, which includes a natural hatred for bad news.

- Think of Napoleon and Hitler when they invaded Russia after using their armies with much success elsewhere.

- The antidote to being made a patsy by past success are…

- To carefully examine each past success, looking for accidental, non-causative factors associated with success that will tend to mislead as one appraises odds implicit in a proposed new undertaking.

- To look for dangerous aspects of the new undertaking that were not present when past success occurred.

- The damage to the mind that can come from liking and loving: while being of strong character and ability, being associated with someone of questionable character and ability due to like/love will make others question yours too.

- People underappraise both the competency and morals of competitors they dislike.

- Persian Messenger Syndrome: killing the messenger who brings bad news.

- The antidote: a habit of welcoming bad news. “Always tell us the bad news promptly. It is only good news that can wait.”

- Influence from this tendency often has a shocking effect that helps swamp the normal tendency to return favour for favour. Sometimes, when one receives a favour, his condition is unpleasant, due to poverty, sickness, subjugation, or something else. In addition, the favour may trigger an envy-driven dislike for the person who was in so favourable a state that he could easily be a favour giver. Under such circumstances, the favour receiver prompted partly by mere association of the favour giver with past pain, will not only dislike the man who helped him but also try to injure him.

- A final serious clump of bad thinking caused by mere association lies in the common use of classification stereotypes.

- Simple, Pain-Avoiding Psychological Denial

- The reality is too painful to bear, so one distorts the facts until they become bearable.

- “It is not necessary to hope in order to persevere.”

- Alcoholics Anonymous routinely achieves a fifty percent cure rate by causing several psychological tendencies to act together to counter addiction.

- Excessive Self-Regard Tendency

- Man mostly misappraises himself on the high side, like the ninety percent of Swedish drivers that judge themselves to be above average. Such misappraisals also apply to a person’s major “possessions.”

- Endowment effect: once owned, objects suddenly become more worth to someone than he would pay if they were offered for sale to him and he didn’t already own them.

- Man’s excess of self-regard typically makes him strongly prefer people like himself.

- Some of the worst consequences in modern life come when dysfunctional groups of cliquish persons, dominated by this tendency, select as new members of their organizations persons who are very much like themselves.

- In lotteries, the play is much lower when numbers are distributed randomly than it is when the player picks his own number.

- Extremely counterproductive is man’s tendency to bet, time after time, in games of skill, like golf or poker, against people who are obviously much better players.

- The antidote to bad hiring decisions based on impressions in face-to-face contact is to underweight face-to-face impressions and overweigh the applicant’s past record.

- “Tolstoy effect”: the worst criminals don’t appraise themselves all that bad. They come to believe either (1) that they didn’t commit their crimes or (2) that, considering the pressures and disadvantages of their lives, it is understandable and forgivable that they behaved as they did and became what they became. It is this second part that is enormously important: man makes excuses for his fixable poor performance, instead of providing the fix. It is very important to have personal and institutional antidotes limiting the ravages of such folly…

- Fixable but unfixed bad performance is bad character and tends to create more of itself, causing more damage to the excuse giver with each tolerated instance.

- In demanding places, like athletic teams and General Electric, you are almost sure to be discarded in due course if you keep giving excuses instead of behaving as you should.

- The main antidotes are…

- A fair, meritocratic, demanding culture plus personnel handling methods that build up morale.

- Severance of the worst offenders.

- The antidote to folly from an excess of self-regard is to force yourself to be more objective when you are thinking about yourself, your family and friends, your property, and the value of your past and future activity.

- “Never underestimate the man who overestimates himself.”

- The most desirable form of pride is a justified pride in being trustworthy.

- Overoptimism Tendency

- “What a man wishes, that also will he believe.” – Demosthenes

- One antidote to foolish optimism is trained, habitual use of the simple probability math of Fermat and Pascal.

- Deprival-Superreaction Tendency

- Loss seems to hurt much more than the gain seems to help.

- If a man almost gets something he greatly wants and has it jerked away from him at the last moment, he will react much as if he had long owned the reward and had it jerked away.

- Man frequently incurs disadvantage by misframing his problems. He will often compare what is near instead of what really matters.

- A man ordinarily reacts with irrational intensity to even a small loss, or threatened loss, of property, love, friendship, dominated territory, opportunity, status, or any other valued thing.

- This tendency often protects ideological or religious views by triggering dislike and hatred directed toward vocal nonbelievers.

- When the vocal critic is a former believer, hostility is often boosted both by…

- A concept of betrayal that triggers additional Deprival-Superreaction Tendency because a colleague is lost.

- Fears that conflicting views will have extra persuasive power when they come from a former colleague.

- One antidote to intense, deliberate maintenance of groupthink is an extreme culture of courtesy, kept in place despite ideological differences.

- Another antidote is to deliberately bring in able and articulate disbelievers of incumbent groupthink.

- The most addictive forms of gambling provide a lot of near misses and each one triggers Deprival-Superreaction Tendency.

- The best antidote to being triggered into paying foolish prices at open-outcry auctions is the simple Buffett practice: Don’t go to such auctions.

- Deprival-Superreaction Tendency and Inconsistency-Avoidance Tendency often join to cause one form of business failure. In this form of ruin, a man gradually uses up all his good assets in a fruitless attempt to rescue a big venture going bad.

- Social-Proof Tendency

- Man’s evolution left him with an automatic tendency to think and act as he sees others around him thinking and acting.

- It’s wise for parents to rely more on manipulating the quality of the peers than on exhortations to their own offspring.

- Triggering most readily occurs in the presence of puzzlement or stress, and particularly when both exist.

- Because both bad and good behaviour are made contagious by this tendency, it is highly important that human societies…

- Stop any bad behaviour before it spreads.

- Foster and display all good behaviour.

- “Serpico Syndrome”: corruption being driven by social proof plus incentives.

- In social proof, it is not only action by others than misleads but also their inaction.

- In advertising and sales promotion, this tendency is about as strong a factor as one could imagine. “Monkey-see, monkey-do.”

- This tendency often interacts in a perverse way with Envy/Jealousy and Deprival-Superreaction Tendency.

- Learn how to ignore the examples from others when they are wrong, because few skills are more worth having.

- Contrast-Misreaction Tendency

- Because the nervous system of man does not naturally measure in absolute scientific units, it must instead rely on something simpler. The eyes have a solution that limits their programming needs: the contrast in what is seen is registered. And as in sight, so does it go, largely, in the other senses. Moreover, as perception goes, so goes cognition. The result is this tendency.

- This tendency is routinely used to cause disadvantage for customers buying merchandise and services. To make an ordinary price seem low, the vendor will very frequently create a highly artificial price that is much higher than the price always sought, then advertise his standard price as a big reduction from his phony price.

- When a man’s steps are consecutively taken toward disaster, with each step being very small, the brain’s tendency will often let the man go too far toward disaster to be able to avoid it. This happens because each step presents so small a contrast from his present position.

- “A small leak will sink a great ship.” – Benjamin Franklin

- Stress-Influence Tendency

- Everyone recognizes that sudden stress, for instance from a threat, will cause a rush of adrenaline in the human body, prompting faster and more extreme reaction.

- Light stress can slightly improve performance – say, in examinations – whereas heavy stress causes dysfunction.

- Pavlov found in his stress-inducing experiments to dogs…

- He could classify dogs so as to predict how easily a particular dog would breakdown.

- The dogs hardest to break down were also the hardest to return to their pre-breakdown state.

- Any dog could be broken down.

- He couldn’t reverse a breakdown except by reimposing stress.

- Availability-Misweighing Tendency

- The mind overweighs what is easily available and thus displays this tendency.

- The antidote to miscues from this tendency often involve procedures, including use of checklists, which are almost always helpful.

- Another antidote is to behave somewhat like Darwin did when he emphasized disconfirming evidence. What should be done is to especially emphasize factors that don’t produce reams of easily available numbers, instead of drifting mostly or entirely into considering factors that do produce such numbers.

- Still another antidote is to find and hire some skeptical, articulate people with far-reaching minds to act as advocates for notions that are opposite to the incumbent notions.

- The special strength of extra-vivid images in influencing the mind can be constructively used…

- In persuading someone else to reach a correct conclusion.

- As a device for improving one’s own memory by attaching vivid images, one after the other, to many items one doesn’t want to forget.

- An idea or a fact is not worth more merely because it is easily available to you.

- Use-It-or-Lose-It Tendency

- All skills attenuate with disuse.

- If a skill is raised to fluency, instead of merely being crammed in briefly to enable one to pass some test, then the skill…

- Will be lost more slowly.

- Will come back faster when refreshed with new learning.

- A wise man engaged in learning some important skill will not stop until he is really fluent in it.

- Drug-Misinfluence Tendency

- Senescence-Misinfluence Tendency

- With advanced age, there comes a natural cognitive decay, differing among individuals in the earliness of its arrival and the speed of its progression. Practically no one is good at learning complex new skills when very old. But some people remain pretty good in maintaining intensely practised old skills until late in life.

- Authority-Misinfluence Tendency

- Man was born mostly to follow leaders, with only a few people doing the leading.

- Careful thinkers like Buffett, who always acts like an overquiet mouse around his pilots.

- Almost any intelligent person with this checklist of psychological tendencies in his hand would, by simply going down the checklist, have seen that Milgram’s experiment involved about six powerful psychological tendencies acting in confluence to bring about his extreme experimental result.

- Be careful when you appoint to power because a dominant authority figure will often be hard to remove, aided as he will by this tendency.

- Twaddle Tendency

- Man, as a social animal who has the gift of language, is born to prattle and to pour out twaddle that does much damage when serious work is being attempted.

- Reason-Respecting Tendency

- There is in man, particularly one in an advanced culture, a natural love of accurate cognition and a joy in its exercise.

- Few practices are wiser than not only thinking through reasons before giving orders but also communicating these reasons to the recipient of the order.

- Carl Braun’s rule: you have to tell Who was to do What, Where, When, and Why.

- This tendency is so strong that even a person’s giving of meaningless or incorrect reasons will increase compliance with his orders and requests.

- Lollapalooza Tendency – The Tendency to Get Extreme Consequences from Confluences of Psychological Tendencies Acting in Favour of a Particular Outcome

Short list of examples reminding us of the great utility of elementary psychological knowledge.

- Carl Braun’s communication practices.

- The use of simulators in pilot training.

- The system of Alcoholics Anonymous.

- Clinical training methods in medical schools.

- The rules of the U.S. Constitutional Convention: totally secret meetings, no recorded vote by name until the final vote, votes reversible at any time before the end of the convention, then just one vote on the whole Constitution.

- The use of Granny’s incentive-driven rule to manipulate oneself toward better performance of one’s duties.